We can calculate the daily compound interest in Excel using the mathematical formula for compound interest or the FV function.

Compound interest is the interest calculated on the principal amount and any previously accumulated interest. In other words, your investment earns interest on your interest.

If the interest is accumulated daily, your investment is subject to daily compound interest. Daily compounding also applies to other areas, such as loans and credit cards.

Compound interest can even be applied in areas outside of finance. For example, statisticians use the compound interest formula to model population growth.

In this guide, we will explain how to calculate the daily compound interest of an investment or loan. We will show you how to apply the formula for compound interest using Excel functions.

Let’s dive right in!

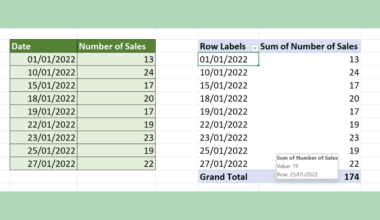

A Real Example of Calculating Daily Compound Interest

Let’s take a look at a quick example where we may need to calculate daily compound interest.

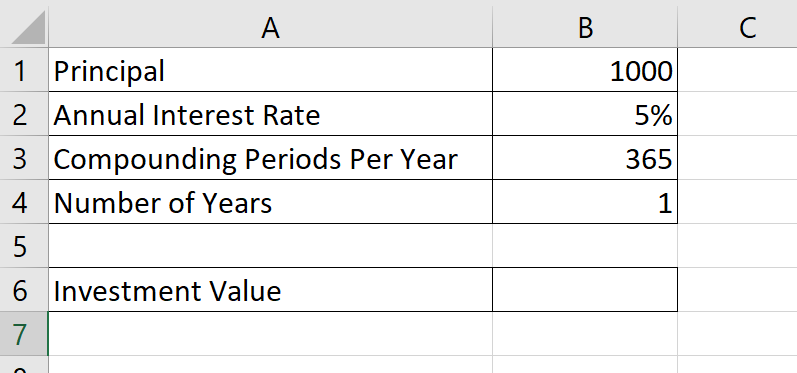

Suppose you invested $1000 into a high-interest savings account. If the account compounds daily with an interest of 5%, how much will your investment grow after a year?

To compute the daily compound interest, we can use the following formula:

Daily Compound Interest = (Principal * (1 + Annual Rate/365) ^ (Years * 365)) - Principal

In the example described above, our principal would be the amount loaned from the bank ($10,000), and our annual rate will be the bank’s 5% interest rate.

The formula computes the total amount with compound interest and subtracts the initial principal to find the total accumulated interest.

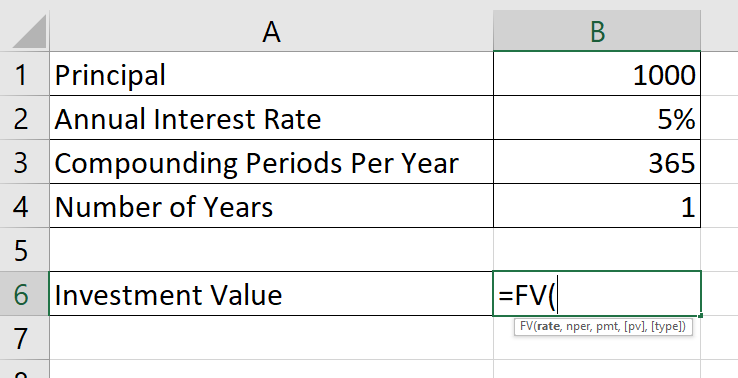

Excel also includes the built-in function FV that allows users to calculate the future value of a given investment.

We can use the compound interest formula to determine the future value of your investment.

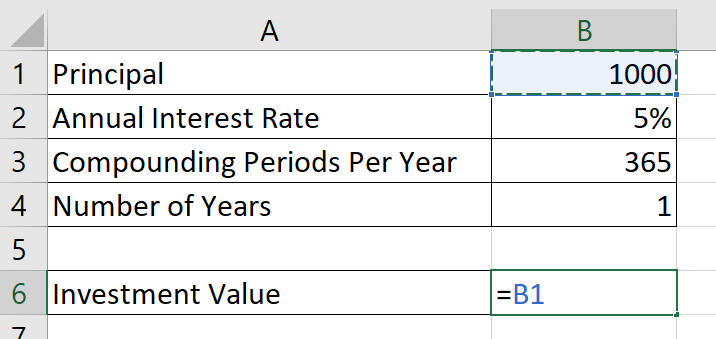

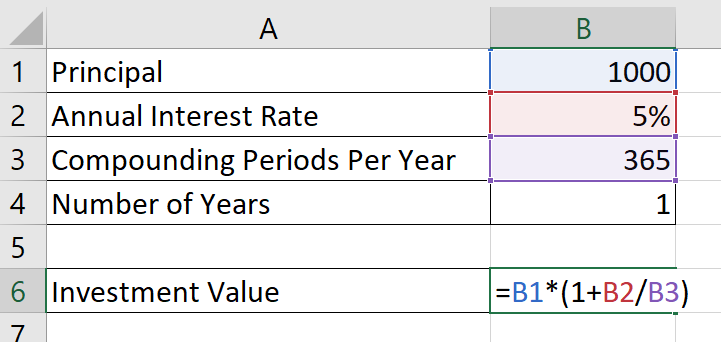

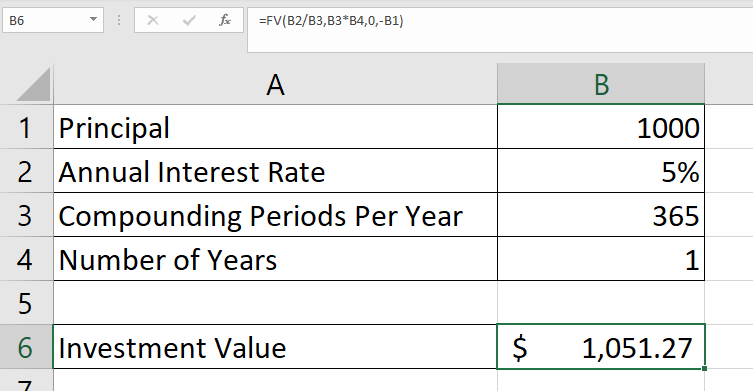

To get the value in cell B6, we just need to use the following formula:

=B1*(1+B2/B3)^(B3*B4)

We can also use the FV formula to determine the value of your investment after a single year:

=FV(B2/B3,B3*B4,0,-B1)

The FV function requires at least four arguments: the interest rate per compounding period, the number of compounding periods, the amount paid per period, and the initial amount invested or borrowed.

Do you want to take a closer look at our examples? You can make your own copy of the spreadsheet above using the link attached below.

If you’re ready to try calculating daily compound interest yourself, head over to the next section to read our step-by-step breakdown on how to do it!

How To Calculate Daily Compound Interest In Excel

This section will guide you through each step needed to start calculating daily compound interest.

Follow these steps to start calculating daily compound interest:

- First, the user must specify the principal amount. The principal refers to the initial amount of a loan or investment.

In our example, we’ve invested $1000 into our savings account.

In our example, we’ve invested $1000 into our savings account. - Next, the user must specify the annual interest rate.

- For daily compound interest, we should specify that there are 365 compounding periods in a single year. We should also specify how many years our investment will keep accumulating interest.

In our example, we want to see the amount accumulated after a single year of daily compound interest.

In our example, we want to see the amount accumulated after a single year of daily compound interest. - Next, we’ll use the compound interest formula to find the daily compound interest. Start by entering the principal amount.

- Multiply the principal amount by the value (1+Rate/365). We divide the rate by 365 since there are 365 compounding periods for the year.

- Use the ‘^’ symbol to raise the current value by

(t*365)where t equals the number of years the investment will accumulate interest.

- Hit the Enter key to evaluate the daily compound interest formula. If you want to see just the accumulated interest, you must subtract the principal amount from the total amount with interest.

- Next, we will show you how to use the

FVformula to find the future value of your investment.

Start by typing “=FV(“ to begin theFVformula.

- The first argument of the

FVformula is the rate per compounding period. We can provide the rate by dividing the annual interest rate by 365.

- Next, we’ll multiply the number of years by 365 to get the total number of periods to compute. The third argument refers to the payment made for each period.

Since no payments are made in this scenario, we must specify a value of 0.

- The fourth argument of

FVindicates the present value. We add a “-” symbol before our value to indicate that we are making an investment, and we want the function to return a positive value as output.

- Hit the Enter key to evaluate the

FVfunction. In this example, we’ve determined that our principal investment of $1000 will have a future value of $1051.27 after a single year.

These are all the steps you need to calculate daily compound interest in Excel.

This step-by-step guide should provide you with all the information you need to begin calculating daily compound interest in Excel. We’ve shown you how to find daily compound interest using the compound interest formula and the built-in FV function.

Finding daily compound interest is just one example of the many ways Excel can help you calculate your finances. For example, you can read our guide on the FV formula to learn more about how to compute different types of compound interest.

You may also check our guide on finding monthly compound interest if your loan or investment compounds interest every month instead.

If you’re still looking to learn more about Excel, be sure to check out our library of Excel resources, tips, and tricks! Our website offers hundreds of other functions and methods to help you get more out of Microsoft Excel.